Why Towler & Associates, CPAs?

- We are focused on small businesses!

- We don’t just work with numbers, we work with your needs.

- We listen and respond quickly, year round.

- We are trusted accountants and tax advisors

Business Matters January 2020

Jan 07, 2020

Technology

Performing Transactions Online: Know What’s Happening to Your Data

Online purchasing transaction security is not absolute. There are not really “safe” and “unsafe” options anymore, meaning only alternatives remain that have varying degrees of security. However, understanding how your data is stored and used is an important first step.

What are the risks of purchasing online?

The risks of conducting transactions online are real and require constant vigilance. Online transactions are open to “normal” procurement risks, but also have a unique set of other hazards. Beyond being exposed to such things as fake websites, inflated user reviews, or the possibility of never actually receiving what was bought, purchasers can be exposed to much more sinister dangers. Credit card fraud and identity theft are real possibilities. It is not all doom and gloom though. The key is understanding these risks and what is being done to protect you and your personal data.

What information can online retailers store?

The storing of personal data is controlled more by the industry than by federal or provincial laws. The Payment Card Industry Data Security Standard (PCI DSS) was implemented by the major credit card companies as a means of ensuring compliance amongst the retailers, online or otherwise. Deviation from compliance is met with stiff fines. Per PCI DSS direction, brick and mortar stores are required to keep customer data only until they have been successfully authenticated. Online retailers face similar restrictions. However, when it comes to saving data for repeat transactions, customer data can be saved if it is properly encrypted and guarded. Due to the complex nature of storing and managing customer data in this manner, this function is often off-loaded to third-party providers.

The actual data that is stored by online retailers, per the PCI DSS, is the customer’s:

- name

- account details

- credit card number (a.k.a. Primary Account Number or PAN)

- the expiration date

Not to be stored are the customer’s:

- PIN number

- the security code (CVV).

Further, access to the stored data is to be restricted, and the full PAN must be concealed. Policies must also be in place to destroy the customer’s data once it is no longer required.

Where is personal information stored?

To understand how your online personal data is stored, it is important to understand that there are two different areas in which your data is stored. First, many people store personal details within their internet browsers (Google Chrome, Firefox etc.). This allows for increased convenience – you don’t have to enter addresses, credit card numbers and other details each time you want to shop online.

Websites can store these details in the form of cookies, or as part of the autofill functionality. Cookies are stored on your computer and accessed by the website when you navigate there, and can store account numbers, even credit card numbers. Recently, browsers have significantly expanded their use of autofill functionality. A large amount of personal data is stored within the browser setting files, and can be accessed to speed up the process for people filling out online forms.

Secondly, retail partners themselves maintain personal data in the form of customer accounts, complete with address, credit card, buying patterns and many other sensitive details. We have all signed up for customer accounts to take advantage of promotions, newsletters, points, or just to speed the checkout process. Online transactions are usually brokered by a Payment Service Provider (PSP). These PSPs tokenize the consumer’s payment details and are usually certified by the relevant agencies. The certification details are often available on the seller’s website. Tokenization means that the data is encrypted as randomized characters and transmitted as such. Interception of this data is meaningless, as the credit card numbers, addresses and other details have been scrambled.

How do you secure your information?

If we think about the two different places where customer data is stored, it makes sense that we will have two different approaches to securing our personal data.

First, make a habit of reviewing and deleting the cookies saved on your computer, especially if other people use your computer. To stop new cookies from being created with your data, simply use the “Guest” option on websites as much as possible. This is usually available on most websites and refers to the option of entering only the personal data needed to conduct the immediate transaction. Much less data is stored for future recovery, or misuse. If you choose to save some of your data, use the autofill functions. This not only speeds up data entry later, but also stores it more securely than with cookies.

Finally, in terms of data stored by online retailers, staying informed and proactive on what data you have out there is important. Take a minute to read the retailer’s security policy and understand their policies in terms of customer data retention, and if they use professional third-party partners to guard your data. Consider whether you really need to create an account with the retailer to speed future transactions. Maybe you will prefer to manage this data yourself.

Management

Top Five Small Business Legal Mistakes

Small businesses face many of the same legal issues as their larger counterparts, but often without the cost structure to support engaging legal counsel. If you own a small business, it’s important to understand when saving legal costs up-front can end up costing your business more in the long run.

All businesses – small, medium or large – make legal mistakes. However, a small business may not be as capable of weathering the storm. The effect of a legal mistake on a small business’s bottom line can be so disastrous that it may threaten its very survival. Accordingly, small businesses must pay extra attention to avoid certain legal mistakes up-front.

Below are the top five legal mistakes small businesses make and how to avoid them.

-

Choose the right business structure

Many small businesses are sole proprietorships, which means there is no legal distinction between the business and the owner. The owner assumes all the liabilities of the business. Accordingly, the personal assets of the small business owner (e.g., house, car, investments etc.) may be seized to pay the debts of the business.

While there is a level of simplicity to operating a sole proprietorship, there are many advantages to incorporation that are worth considering. One of the main advantages is that the business becomes a separate entity under the law. This means that, if the business incurs a large debt or liability, the business’s assets may be seized to satisfy that debt or liability, but the owner’s personal assets are protected. However, this advantage may be impacted if the business owner has personally guaranteed any debt.

Another big advantage is the potential to minimize the owner’s overall tax liability. By incorporating, the owner has three opportunities to reduce the combined corporate and personal tax owed:

- Defer paying personal taxes on business earnings by leaving the earnings in the corporation and paying the lower corporate tax rate. While there is generally a small increase in the overall tax burden by earning income through a corporation and eventually paying it out to the shareholder as a dividend, the benefit of deferring when that tax is paid by leaving the income in the corporation and reinvesting it in the business may offset that increase.

- Pay the owner dividends instead of a salary and pay the lower dividend tax rate.

- Investigate whether you can split income with the spouse or adult children of the owner, though you should be aware of the Tax on Split Income (TOSI) rules which may apply when dividends are paid to family members who are not actively involved in the business. The TOSI rules were significantly expanded in 2018 and are very complex. To see how these rules affect your business you should consult with your CPA.

By minimizing and deferring tax liabilities, the owner of a small business may free up more capital to invest in the business’s future.

-

Put key agreements in writing

All of the small business’s key agreements should be in writing. Verbal agreements are very difficult to enforce and often leave the business with no recourse for compensation or legal action.

Every small business should ensure that its key agreements are properly drafted. This means clearly spelling out each party’s roles and responsibilities, providing the business with the protections it needs against future liability and apportioning risk appropriately. This not only helps ensure everyone is on the same page going forward; if something does go wrong, having the agreement in writing will also help prove the other party’s fault.

In addition, given many small businesses may not have sufficient personnel and working capital to engage in traditional litigation, the parties can agree up-front on a different way to resolve any future disputes that may arise. For example, they could stipulate in the agreement that any disputes be submitted to binding arbitration, which results in a more timely and cost-effective dispute resolution mechanism than litigation.

-

Make sure there are adequate employment agreements

Similarly, it is important for every small business to have properly-drafted employment agreements in place. These serve as the foundation of the business’s relationship with its employees. Common terms include whether the arrangement is permanent or temporary, whether the individual is an employee in the traditional sense or an independent contractor, an outline of the duties and responsibilities, and the rights and restrictions upon termination.

Not having a written employment agreement in place may expose the small business to unnecessary liability in future that could have easily been avoided. For example, if the relationship was not properly documented and managed, a small business that intends to hire an independent contractor may find itself liable for large common law termination and severance amounts once the relationship ends.

-

Register intellectual property rights

Intellectual property is the legal right to ideas, inventions and creations in the industrial, scientific, literary and artistic fields. It also covers symbols, names, images, designs and models used in business.1 In Canada, there are four types of intellectual property rights:

- copyrights

- trademarks

- patents

- industrial designs

Intellectual property is a valuable business asset and it comes with legal rights. Small businesses may be creating valuable intellectual property assets – sometimes without even realizing it – that should be legally protected. If properly protected, the small business has, among other benefits, the ability to prevent competitors from copying or closely imitating its products and services. Without adequate protection, a small business is vulnerable to being driven out of business by a more savvy competitor.

-

Hire a good lawyer to help avoid mistakes

Every small business faces issues that require the expertise of good legal counsel. Unfortunately, in a misguided effort to minimize costs, many owners of small businesses ignore legal issues altogether or try to handle the issues themselves. This results in legal mistakes that may end up costing the business more in the long run and, in certain circumstances, threatening its very survival. Accordingly, it is important for small businesses to engage good legal counsel in key areas of the business to help avoid mistakes.

Like the other four tips provided here, if you own a small business, think of this not as an unnecessary expense, but as a necessary investment in the future of your business.

Wealth Management

Building a Secure Future – Supporting Families With Special Needs

Planning for their children’s financial future is very important to all parents; for families with special needs children, it can involve more complex and emotional decisions. The cost of supporting a special needs child can be more than double the cost of raising a child without special needs. However, some relief may be available to support families to meet their child’s needs. Here are some tips from an investment advisor on how to access those.

While there are many challenges to support your child, the financial aspect can seem daunting to your family. The need to pay for therapies, medical equipment, special programs, along with a parent’s lost income due to time commitments, makes up a large portion of this added cost. If you have a child with special needs, the path to creating a plan to financially support them can be a challenging one that may require the experience and expertise of a financial professional.

As part of your planning, you may wish to learn about help that may be available to you through tax credits, savings vehicles and government programs that support families to meet their child’s needs.

Tax credits may be available

Starting out, families should obtain approval from the Canada Revenue Agency (CRA) to receive the Disability Tax Credit (DTC). This process requires that a medical professional sign off on a government form to establish the child’s eligibility. The DTC provides the parents of a special needs child a transferable credit on their taxes of about $13,000 (in 2018 and assuming child is < 18 years old).

Oftentimes, families may be eligible for the DTC and not even know it. Families may typically associate the DTC with an individual with a visible disability, when in fact, the DTC covers both visible and non-visible medical conditions. For instance, families with loved ones with the following medical conditions may qualify for the DTC: Autism, Cerebral Palsy, Diabetes (Type 1), Down Syndrome. While this list of medical conditions is not exhaustive, the ultimate decision made by CRA will be dependent upon the opinion of a qualified medical professional, on a case-by-case basis.

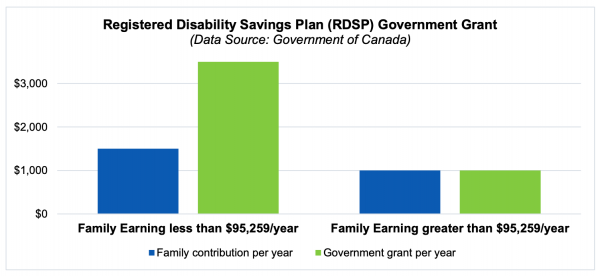

The tax credit gives access to matching programs

In addition, the DTC allows the family to open a Registered Disability Savings Plan (RDSP). The RDSP provides access to government matching grant and bonds, similar to a Registered Education Savings Plan (RESP). Focusing on the government grant, a family’s contribution to an RDSP of $1,000 a year will be matched by a minimum of $1,000. Also, the family’s contributions along with government bond and grant can be invested in a tax-deferred manner, similar to a Tax-Free Savings Account (TFSA). Combined with government incentives, this tax deferral creates the opportunity for the family to build retirement income for their child’s future to offset lifestyle and support expenses.

Government support programs can also include provincial government support. For Ontario residents, this can include the Ontario Disability Support Program (ODSP). The ODSP is accessible once the child reaches the age of 18. The ODSP is a monthly benefit between $1,000 to $2,000 per month depending on the individual’s circumstances, plus medical, dental, vision, education and job training support. The benefit is paid directly to the special needs individual to cover living expenses.

Estate planning is a must

It is critical for parents of special needs children to update their Will and Power of Attorney (POA) documents. Doing this will ensure proper guardianship of their child when they pass away or are unable to care for them. From a financial perspective, there are many opportunities in your estate plan to ensure that your child is provided for. One of the more common and powerful strategies is combining life insurance on the lives of the parents with a Henson Trust in the parents’ Will.

Navigating the details of these programs and plans can be challenging. Despite the complexity, it is important for families to have a plan and to reach out for professional support. Doing so will ensure the family has access to the financial support and peace of mind they require, so they can focus their time and attention on their children.

Links of interest

Disability Tax Credit Application Form (medical professional required to complete)

Human resources

Small Business and HR – the Basics

Congratulations – your business is moving along enough that you need to hire employees! Here are some tips to keep you sane as you navigate the human resources side of your business.

As an independent or small business owner, it may have been fairly simple to manage your human resource (HR) needs: meet your payroll, make sure taxes and commissions were paid, manage vacations and slow periods.

Once you hit the threshold of five employees, did you know that you are required to have these items in place:

- a health and safety policy

- a related committee made up of both employees and management

- regular joint health and safety reviews of your workplace and practices

The move to carrying multiple employees can be a significant advantage to helping you meet your customers’ needs, but it can also cause you a few headaches along the way.

Fortunately, there are plenty of free resources available to you. The federal government has a website devoted to helping small businesses succeed. Its Business and Industry website provides links to provincial resources as well.

Full-time or part-time staff?

Depending on your business, both types of employee might be useful to you. If you have a service-based business, or one that has a technical proprietary product or business model, hiring employees rather than contractors is likely the best way to engage more people in your business.

Customers expect consistency in both products and people in order to build trust with a business. You can best achieve this consistency with good training, coaching and oversight of your employees. This doesn’t mean you have to hire all full-time employees. Depending on the type of business, part-time might also be a good choice.

Employees are considered part-time if they work 30 or fewer hours per week. The benefit of having part-time employees is that you can schedule them to work hours that fit your peak work requirements and not have to worry about keeping them busy all the time. You can also give them flexible numbers of hours, which gives you potential to better control your overhead labour costs.

Making a differentiation between full time and part time staff also allows you to plan for future growth by providing things like benefits, different rates of pay, distinguishing pay-per-hour roles instead of salaried roles, and so on. Moving into the realm of hiring staff means that you should spend some time on some organizational planning – think about how you would like to see your organization operate in the future.

You will also want to think about how you will keep track of all the information about your employees. It can be as simple as keeping a file on your computer for every employee with their employment contract and pertinent information (as long as it is very secure!) and manually calculating your payroll for submission. Or, you’ll more likely want to keep most of your employee data in an HR data management system. These systems can be very helpful, even to very small businesses.

Employees or contractors?

Perhaps instead of the part-time / full-time prospect, you are considering hiring contractors to help you with your work? Many organizations choose to use contractors to supplement their existing workforce when there is a need to build short-term capacity or to cover existing shortages in staffing due to holidays or special projects. Organizations also consider the cost of hiring a contractor to be less than that of an employee, because it reduces the operating overhead needed to cover the employee. On the other hand, a contractor usually comes with a higher price-per-hour requirement than does an employee.

To better understand some key factors, here’s what you need to consider from the perspective of overall cost.

Employees

Your employee will cost you salary and whatever commission, promotion or taxable benefits you would expect to give them. (Taxable benefits are perks you give employees that cost money, but they don’t pay for, such as parking or transit passes, reductions in tuition, or travel points on work-related travel). Your employee will also need physical assets and tools to work with, as well as space in which to work. As well, you’ll need to factor in training, vacations, and additional time for regular labour code-mandated activities such as meal breaks, sick days (see more below), and statutory and/or overtime pay. Of course, you will also need to make employment insurance and CPP contributions.

Contractors

A contractor, on the other hand, generally brings their expertise and their own tools to conduct their work, and you do not necessarily need to give them a permanent space in your location, saving you overhead costs. Also, there is no expectation that you are going to pay taxes for this employee, as it is their responsibility to handle their own tax situation. You will be paying this person more money per hour, but if it does not exceed your total calculated benefits, salary, overtime, and operating costs, it may be worth considering a contract arrangement.

There are other things to consider however – and this relates to business purpose. Additionally, you need to be sure your expectations of your contractor are not that of an employee. A contractor is usually contracted to do a specific activity or provide a specific service, within a certain timeframe. Expect to have negotiations for this work in terms of total work product, hourly or total compensation, and timeframe.

Also, don’t expect that your contractor is going to exclusively work for you in your own field. Many employees have a “side hustle,” but most don’t do it in their own field or with competitors. This doesn’t hold true for contractors. They also have the ability to sub-contract work to others if they feel it is appropriate, or to substitute their own employees or associates where the need arises. If you require a consistent individual to be in place working on something that may be proprietary, confidential, or highly competitive, you may want to take on an employee instead.

Remember this as well: if you do not want a contractor to work for another organization, you really are hiring an employee, even temporarily, and you may hear from the CRA about it when it comes to tax season. It would be a good idea for you to review the CRA’s policies around contract vs. staff in this very accessible document: www.cra-arc.gc.ca/E/pub/tg/rc4110/rc4110-16e.pdf

Work, discipline, and termination

While your employee is working with you, there are some very specific rules in the labour legislation, as well as within employment law, that you need to abide by. Examples of this include meal times, pay equity, overtime calculations, sick days, and employee discipline.

You are required to provide a meal break of 30 minutes for your employees, but you do not have to give other breaks. That said, most employers do. It is up to you to determine how you will work breaks into your employees’ working time. Regular breaks promote better attention paid to detail, so it is a good idea to consider how best to provide them.

Employees are also legally entitled to a certain number of sick days in a year. In Ontario, this is currently three, but you should check with your province to determine what is required for you. These days can be applied to their own sickness or that of their family members. Again, although you only must provide three days by law, keeping sick employees will reduce your overall productivity and may spread illness within your other staff – and have an even greater effect on your productivity!

Vacations for employees are calculated based on their overall wages. Employees are entitled to 4% of their total salary as vacation, which can be calculated and paid with each paycheque or can be accrued and paid to employees when they take equivalent time off. This is a consideration based on your business model and work. As the employer it is your decision, however vacations do help to increase employee satisfaction and loyalty.

The amount you pay your employees cannot be differentiated based on gender, orientation, marital status

or age. Paying employees the same means that, if they literally have the same job (salesperson, dentist, manager), they must be paid the same in a way that is commensurate with their experience, responsibility in the workplace and activity. This is also true when it comes to similar but different types of work as well.

There is also a requirement called pay equity (not equality), to pay people within similar “bands” of pay based on multiple factors including but not limited to:

- level of decision making

- impact on business

- customer contact

- exposure to physical, mental or social situations that cause individual difficulty (this covers everything from dusty workplaces to noise exposure in nightclubs)

If you have individual employees doing different tasks, you might want to look into pay equity in order to help you make decisions on what to pay and why.

Provide training when they start

Not every employee works out. People quit, sure, but when it comes to disciplining or terminating an employee, you need to be careful to be fair and provide enough notice that there is no recourse to you through the courts. A clear job description and expectation of performance are a good start to making sure an employee can be confident in doing their work and in your satisfaction of work done.

When an employee is new, it is important to coach and teach the employee to ensure the work is being done to your satisfaction. As the employee gains more experience, it is important to provide ongoing feedback as appropriate to make sure you are both calibrated to the success of the work. A monthly, quarterly or at least regular review of the work is important to ensure no one is surprised if work is slipping or not going well. You do this with your business numbers and sales, so do it with your people too; they are an asset to your business and need regular review.

And prepare in case they don’t work out

Discipline may require you to write them about any issue and have them acknowledge that it is a serious matter needing attention. Treat this the same as with a supplier. If your supplier didn’t follow through with their contract, you would talk to them, then write them, then formally issue a “last chance” warning, then terminate the contract. Do the same with your employee (where appropriate) so that everyone is clear.

It may be that you need to terminate with severance, pay out their vacation entitlement if you have been accruing it for them, or pay out an agreed-upon expense. There are calculators for Ontario businesses here: www.labour.gov.on.ca/english/es/tools/index.php and other provinces also offer the same or similar calculators.

Expanding your business to better serve your customers and impact your business world is an exciting

time and you can successfully get more help through either hiring employees or contractors. Be careful and thoughtful about your business intentions and goals – and your decisions around bringing on staff will be just as successful as you already are!

Disclaimer: BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.

Authors:

Performing Transactions Online: Know What’s Happening to Your Data Cory Bayly, MBA

Top Five Small Business Legal Mistakes Seema Aggarwal, BSc (Hons), BA (Hons), LLB

Building a Secure Future – Supporting Families With Special Needs Adam McHenry, CFA

Small Business and HR – the Basics Jennifer LePage, MAEd

TIMELY AND INFORMATIVE!

A newsletter for Business Owners, Professionals, and Investors.

Sign up for our

Business Matters Newsletter

Testimonial

WOW! When Susan and I asked you to do our personal income taxes, we had no idea that you could save us so much money. Not only did you reduce my tax bill, but you got a refund for Susan. AND your bill was much less than we thought it might be. Incredible. Thank you, and see you next tax season.

Jeff Shields

Recent Topics

- Return To Work Raises Crucial Legal Questions For Organizations — Feb 22, 2022

- How To Check If You Have Unclaimed Cheques From The Cra — Feb 22, 2022

- 5 Financial Mistakes To Avoid When You’re Young — Feb 22, 2022

- You’ve Just Learned Cra Intends To Review Your Tax Return. Now What? — Feb 22, 2022

- Business Matters June 2021 — Jun 09, 2021