Busness Matters July 2020

2020-07-14

Management

Cannabis Legislation and the Workplace

In October of 2018, the federal government legalized the possession and use of marijuana for recreational and medicinal purposes in Canada. As a result, business owners have been dealing with a changing landscape. This means that they must understand not only the rights of customers but also the rights of their employees.

Smoking in the past

When I was young, smoking was allowed on airplanes. It was a strange situation. The non-smoking section was usually in the middle of the plane, so passengers were affected as tobacco smoke drifted into the front and rear non-smoking sections; however, laws and norms change. In 1989 it became illegal to smoke on domestic flights and, some time later, on international flights as well. Of course, the possession and use of marijuana remained illegal, but as we now know, other changes were coming.

General advice to business

I am not an employment lawyer, but I deal with a lot of businesses and receive a lot of inquiries about the impact of changes in the legal landscape. My advice with respect to employment-related matters remains consistent ‒ it is essential to implement employment policies that address the changes effected by new legislation, including the legalization of the use of marijuana.

Business polih4cy

Many businesses already have policy manuals; however, many of those manuals have yet to be updated to deal with the change in marijuana legislation. Our firm, for example, implemented a no-smoking policy many years ago. This makes sense, because the building in which we practise is a non-smoking building; however, implementing a simple no smoking policy is not sufficient to restrict the use of marijuana in the workplace. It was necessary for us to update our policies when the legislation came into effect last year.

Going forward

A company should discuss any changes to their current policies with their employment lawyer. If your business is non-unionized, your lawyer must consider whether the change is what is referred to as a “fundamental change.” If your workplace is unionized, the policy must be consistent with the collective agreement. A marijuana policy should address both recreational and medicinal uses. The relevant federal legislation includes both the Access to Cannabis for Medical Purposes Regulations as well as the Cannabis Act, which legalizes the use of marijuana for recreational purposes. In addition, various provincial laws apply.

Other legal implications

Employees who are prescribed marijuana for medicinal purposes may have grounds for complaint under human rights legislation if their employer prohibits them from using the drug. For example, one would consider whether marijuana use is related to a disability and if the employer was obliged to accommodate its use. That is a very different situation than using the drug for recreational purposes.

Workplace safety

Whether the use is for recreational or medicinal purposes, an employer must be aware that marijuana may affect an individual’s ability to work.

The following are some questions to consider when implementing a marijuana policy in the workplace:

- Is there reason to be concerned about the drug’s use in safety-sensitive positions?

- How is a need to use marijuana medicinally accommodated? For example, your policy may require confirmation of certain information from a physician before use is permitted.

- How is suspected consumption of the drug addressed?

- What is the procedure for registering concerns or suspicions about marijuana use?

- What is the investigation process in place once a complaint regarding marijuana use is received?

Workplace drug testing

The issue of workplace drug testing is challenging. Any policy should clearly set out the rules that relate to drug testing. The employer’s obligation to ensure workplace safety must be balanced against the privacy rights of the employee. Establishing impairment itself can be difficult in that tetrahydrocannabinol (THC), an active component in marijuana, can remain in the blood for up to 30 days after the drug is used. This makes it difficult to establish the time that the drug was consumed. As is always the case with employment-related matters, it is essential to be consistent and practical. Any actions taken must be reasonable in the circumstances. Policies should be periodically reviewed by an employment lawyer who practises in your jurisdiction to ensure that they comply with both federal and provincial laws. No one ever said that change would be easy.

Taxation

How Professionals and Business Owners Can Supersize Their Retirement Savings

Professionals and business owners (“owners”) have a unique planning opportunity available to them through incorporation. The use of a corporation can be very beneficial for an owner if they are in the habit of saving within their corporation. Small businesses have access to the Small Business Tax Deduction (SBTD), which is a deferral of tax paid when assets are retained inside the owner’s corporation. The ability to defer paying taxes allows owners to compound their assets inside their corporate structure at a higher rate than if the money was withdrawn, personal income tax was paid and the after-tax amount was invested personally in a non-registered account outside of the owner’s corporation.

Legislative landscape

Recent government tax changes (legislation passed in 2018 and will come in effect later in 2019) placed a limit on the amount of passive income (i.e., interest, dividends and some capital gains) that an owner could generate inside their corporation, which is $50,000 for 2019. An owner with passive income above this $50,000 limit would have their SBTD clawed back and eliminated when passive income exceeds $150,000. As a result of this tax change, owners should review their financial strategy to ensure that their SBTD is protected and the attractive tax deferral benefit is retained as part of the owner’s longer-term retirement savings plan.

More specifically, this recent change in legislation has revived an old planning strategy: The Individual Pension Plan (IPP). For an owner over the age of 40 and earning more than $147,222 annually, the IPP can be a very attractive planning tool for protecting their SBTD for the following reasons:

- higher annual tax-deductible registered account contributions

- opportunity for surplus tax-deductible contributions

- tax-deductible administration costs and election to purchase past service

Corporate tax deductions

IPP contributions are based on the owner’s age, while RRSP maximums are indexed to inflation. As a result, an owner over 40 will see greater contribution room to their retirement savings plan. For example, in 2019, at age 40, an owner could contribute $28,734 to their IPP or $26,500 to their RRSP. Comparatively, in 2019, at age 60, an owner could contribute $41,936 to their IPP or $26,500 to their RRSP.

Surplus corporate tax deductions

Additionally, the ability to contribute more corporate money to the IPP may be available to an owner if the rate of return in the IPP falls short of the government-prescribed 7.5% per year. Given the current interest rate outlook (Government of Canada 10-year bond at approximately 1.44%), achieving 7.5% over the foreseeable future for any investor, let alone a conservative investor, seems daunting. As a result, the corporation would be required to contribute more corporate money to the IPP to make up any return shortfall. Therefore, assets are being shifted from the corporate investable assets to the IPP and further reducing passive income capacity and risk to the business owner’s SBTD.

Servicing cost tax deductibility

Further encouraging the shifting of assets from passive income assets to registered assets is the fact that both investment management fees and actuarial charges are tax-deductible to an owner’s corporation. Actuarial and annual reporting charges are unique to IPPs, as a licensed actuary must complete a funded status valuation of the plan every three years at a minimum, while regulatory filings and bookkeeping activities may also be required. However, this actuarial charge is more than offset by the fact that investment management fees are tax-deductible to the corporation compared to an RRSP scenario where these fees cannot be personally or corporately deducted. As a result, if we assume that the actuarial charges and investment management fees offset one another, the assets still shift from the corporate investable assets (where fees are paid) to the IPP (where fees are incurred).

Purchase of past service

Lastly, similar to an RRSP (which accumulates RRSP contribution room over time), an IPP allows for the purchase of past service. An owner may have had years where they were not able to contribute enough for retirement. In this scenario, the owner can make a lump sum contribution from their corporate investment assets to their IPP to make up any deficiency. As a result, assets are shifted from corporate non-registered investable assets to the IPP, thereby reducing the balance of corporate investable assets that may produce passive income that would risk the owner’s SBTD.

IPP due diligence

This planning strategy can provide significant retirement and tax benefits to an owner with the ability to incorporate. However, establishing an IPP should be made after careful deliberation, as the following disadvantages may actually outweigh the benefits of the plan (as compared to an RRSP):

- complications in the setup and administration of the plan

- restrictions on what the IPP can invest in

- restrictions on IPP investments

- possible annual contribution requirements

Before committing to this long-term strategy, it is vital to work with an experienced financial professional with the knowledge and capacity to handle IPP planning for owners.

Digital MAnagement

Should I Move to the Cloud? Understanding the Business Case

One of the most important trends affecting both small and large organizations alike is the availability of a cloud infrastructure. Even as new applications and functionalities are being marketed, it is now commonplace to see references to such increasingly popular terms as “cloud-based,” “hosted” or “on-premise” (on-prem). It can be extremely overwhelming to digest the various systems and the different ways in which they operate. However, understanding the primary factors to consider for each of the available choices can help you decide on the best route to take.

What is 'the cloud’

Cloud computing is the sleek marketing term for accessing your resources from remote servers that are hosted by third parties, relieving you of the responsibility of maintaining the servers at your own location. This relatively recent capability has only now become an option due to the major advancements in network and communication technology. In the past, the servers hosting key software needed to be physically located close to the end users, as there was extreme performance degradation over even short distances.

In addition to the communication and network advancements, hosting companies are now able to effectively create virtual environments for their clients. These virtual areas mimic a physical server environment where the client’s software is deployed and then accessed remotely. The virtual environments are already configured, so rapid deployment or expansion are significantly improved over traditional methods. There are no capital expenditures, data backup processes are easily configured, and organizations only pay for the resources that they use.

Cloud environments also come in a variety of flavours. There are private clouds, public clouds and even hybrid cloud solutions available. When evaluating a cloud solution, take the time to understand:

- the level of autonomy your organization will have in the cloud

- any imposed restrictions to changes

- data ownership caveats

- any special licensing requirements

Is on-prem dead?

The physical internal hosting of an organization’s applications has long since been the cornerstone architecture in place. Data security, proprietary software and complete ownership are undeniably maintained. Ultimate security and control still come with physical ownership and maintenance of the hardware. In fact, many industries have specific requirements for the governance of their data and software that stipulate physical control.

The on-prem architecture does have its challenges. Physically hosting your own servers and applications means you must also provide the necessary administrative components. Licensing, data growth strategies, security, hardware maintenance, monitoring and support are all necessary items that need to be planned and costed. Ultimately, all these items require specific (and often costly) IT resources.

On-prem vs. the cloud

As previously mentioned, there are several considerations when deciding what path to take. The following table outlines the key differences between on-prem and cloud environments that can greatly affect your organization.

| Consideration | On-prem | Cloud |

|---|---|---|

| Deployment | Deployments involve purchasing the hardware, installing the software and then maintaining it. Not only can on-prem deployments be complex and expensive, but you also must support them yourself. | Deployments are much simpler. Resources are only allocated as needed. Though the initial conversion to the cloud needs to be properly planned, it is often far less involved than is the case with on-prem. |

| Control | Environments retain complete control over the access and care of their data as well as the physical hardware. This can be especially important in highly regulated or security-conscious industries. | The ownership of the data has been an ongoing and complex debate in cloud environments. This is especially true when a cloud provider is in another country, potentially exposing a user to further complications if required to comply with foreign data protection (and access) rules. |

| Security | Users have a unique challenge in this space. While they have the direct control of their data and hardware, they need a fair amount of expertise to properly secure and protect this data. While users may have ultimate control over their data, they also have the sole responsibility to protect it. | Users are faced with a different problem in this space. While one of the primary advantages of using a reputable cloud provider is the high level of security and maintenance expertise, users are ultimately reliant on someone else to protect their information. As has been all too frequent with data breaches as of late, this is a serious concern. |

| Cost | On-prem costs are the most familiar, as this has been the legacy way of operating. Costs include determining the hardware needed, software licensing and any other implementation costs. Care needs to be taken to ensure that the costs associated with ongoing maintenance are considered. | Costs are typically in line with the alternative, with a few exceptions. It may appear more expensive to be paying for the service, but you also only pay for what you use. You no longer must size your infrastructure for the level of growth expected. You can simply ramp up additional services as needed. |

A note on Software as a Service

With the evolution of computing environments that can now realistically support accessing resources remotely, Software as a Service (SaaS) has also quickly become available. SaaS mainly follows the same pattern as on-prem and the cloud. However, rather than having to buy and license your own software (for large upfront costs), you can basically lease the applications for a monthly fee. Not only does this reduce the upfront investment, but it also typically gives users immediate access to the latest software versions.

Wealth Management

The Value of Estate Planning and Charitable Giving

Dying is not a popular topic of discussion, for obvious reasons, but it is a reality of life. However, planning ahead for your estate could prove to be very rewarding, as it would provide both you and your loved ones with added security and peace of mind.

Minimizing taxes

While you are still working and collecting an income, a typical strategy you might employ is tax minimization, with a focus on reducing annual income tax bills. With estate planning, the theme of tax reduction should remain the same, with the only difference being that the beneficiary of the tax savings will change from yourself to your selected beneficiaries.

Choosing beneficiaries

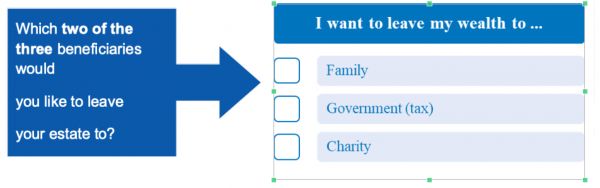

Many clients don’t realize that they have a choice of three beneficiaries to their wealth:

- family

- government (tax)

- charity

When a person dies, the default beneficiaries selected for them are family and government. However, people typically prefer to bequeath their wealth to family and charity, which requires proper estate planning. There are many tax-efficient ways to achieve this desired estate allocation, but they all require forward-planning while the individual is still alive.

Tax minimization strategies

The following strategies, when properly planned for ahead of time, can ensure that your family and preferred charity are the recipients of your wealth when you pass away:

- bequest in will

- gift of publicly traded securities

- registered account beneficiary designation

- life insurance beneficiary designation

The simplest approach is often to update your will and/or registered account beneficiaries. Making a charity a beneficiary in your will requires that you coordinate these details with your legal professional. On the other hand, designating a charity as a beneficiary to your Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) requires that you coordinate with your financial institution.

The newest option for tax-efficient charitable giving is a gift of publicly traded securities to a registered charity. When a person dies, the estate may opt to avoid the tax on the capital gains on the deemed-to-be-disposed-of appreciated securities, while still receiving a tax receipt for the full market value of the contribution. Lastly, by using the powerful multiplication effect of tax-exempt life insurance, a significant gift can be created for charity while reducing or eliminating estate taxes. In addition, life insurance can have the added benefit of reducing annual income taxes while you are still alive, as premiums paid where the beneficiary of the policy is a registered charity are eligible for a tax credit.

Creating an estate plan that designates beneficiaries for registered accounts and life insurance has the added benefit of reducing or eliminating probate and estate administration costs. As a result, the estate may be settled faster and more assets may be retained in your estate, allowing greater wealth to be distributed to your loved ones and preferred charity.

Disclaimer: BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.

Authors:

Cannabis Legislation and the Workplace Christene H. Hirschfeld, Q.C., ICD.D

How Professionals and Business Owners Can Supersize Their Retirement Savings Adam McHenry, CFA

Should I Move to the Cloud? Understanding the Business Case Cory Bayly, MBA

The Value of Estate Planning and Charitable Giving Adam McHenry, CFA