Business Matters February 2020

2020-02-09

Wealth management

Why Should You Care About Your Health Care Spending Account?

Families may not realize that they have a great opportunity to significantly reduce the cost of medical treatments and therapies through a health care spending account (HCSA). These accounts are not well understood and, if available, are typically underutilized due to a lack of awareness of how they can help.

In essence, the HCSA helps families pay for eligible medical expenses by using pre-tax money. For families who incur medical expenses that are not traditionally covered by their employer’s group benefits plan, an HCSA can be a very powerful tax-saving tool. Typically, if you are an employee of a company, you have access to the HCSA as a supplement to your traditional group benefits program. If you do have this access, you may receive a portion of your total compensation in the form of HCSA funding, up to a certain limit.

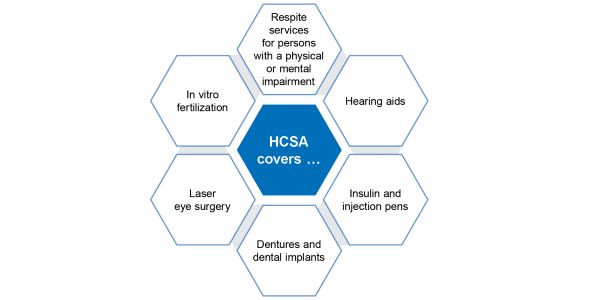

Eligible expenses that are not traditionally covered by your family’s group benefits plan, but are covered through a health care spending account (HCSA), include these:

Tax savings available

If your family has qualifying medical expenses above $2,302 (2018) or 3% of your income per year and your marginal tax rate is greater than 20%, then the HCSA could be a valuable tool for your family.

To estimate your potential tax savings from using an HCSA, simply take the difference between your combined marginal tax rate and the federal and provincial tax credit (METC) amount on qualifying medical expenses. If you are an individual in the top marginal bracket living in Ontario (53.53%), the tax savings are your qualifying medical expense amount (incurred during the year), multiplied by the tax rate difference between your marginal tax rate (53.53% less HCSA administrative costs of 8%) and the METC credit (15% federal plus 5.05% Ontario resident), which is approximately 25.48%.

For a family with large medical expenses during the year (such as respite services), the resulting tax savings can be significant. For instance, if a family incurs qualifying medical expenses of $15,000 in a year, the resulting tax savings from using an HCSA instead of the METC is close to $3,822! In addition, if qualifying medical expenses are incurred regularly every year, this is an ongoing tax savings to the family.

Business owners can improve both their financial situation and that of their employees by making a health care spending account part of their benefits offering </>

Implementing an HCSA as part of your benefits offering can be very valuable for you as a business owner. Up front, the business receives a tax deduction on contributions to an HCSA, while the employees do not pay tax on contributions to the HCSA or on eligible expenses. As a result, the employee is farther ahead by avoiding income tax on HCSA eligible expenses. In addition, the business owner has clarity of costs with an HCSA, as it is the employer that elects to contribute and at what amount. This contrasts with a traditional group benefits plan, which can have variable costs due to the group’s unpredictable claims experience.

In some circumstances, business owners might just offer an HCSA without a traditional group benefits plan. In this case, the employee has full flexibility to use the HCSA dollars for whatever purpose they prefer, while the business owner doesn’t have to worry about escalating benefits costs. If, however, the employee would still like the option of a traditional group benefits plan, they can use their HCSA dollars to purchase

a plan for themselves, as premiums are an eligible expense for HCSA purposes.

Navigating the details of a health care spending account program is challenging. Despite the complexity, it is an important planning tool for families and business owners to use, to improve wellbeing and financial outcomes.

Links of interest

Canada Revenue Agency (CRA) – Eligible medical expenses you can claim on your tax return:

www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-330-331-eligible-medical-expenses-you-claim-on-your-tax-return.html

Canadian Broadcasting Corporation (CBC) – HSAs the best health plans you’ve never heard of:

www.cbc.ca/news/business/hsas-the-best-health-plans-you-ve-never-heard-of-1.990547

Management

Workplace Accommodations: Choosing to See Ability in Disability

When most people think of a disability, the image of a wheelchair or prosthetic comes to mind. Yet, for those with an invisible disability, the mental image is often less kind and many people tend not to disclose their disability for fear of stigma or discrimination. However, some employers are discovering that the key to successfully integrating workers with invisible disabilities lies in meeting employees where they are – which means being willing to adapt workplaces, workspaces and processes to accommodate workers with differing needs and workstyles.

What is an invisible disability?

Generally, a disability or impairment that is not visible to the eye is an “invisible disability.” For example, persons suffering from depression, anxiety, Lyme disease, autism spectrum disorder (ASD) or lupus can experience hindrances, pain, or physical limitations that are not readily perceived by those around them.

A 2011 Canadian survey revealed that 88% of people with invisible disabilities had a negative view of disclosing their disability (Holland, 2017), primarily due to fear of reprisal from their employer.

Why are employers becoming more accepting of employees with invisible disabilities?

While employers can gain from a workforce that includes diverse cultures, backgrounds or gender, there is an increasing willingness to accommodate invisible disabilities in exchange for valuable employee contributions. Some employers have discovered that people with ASD, or “non-neurotypical” people, also bring their own strengths including attention to detail, innovation, value, creativity and loyalty. In other instances, employees who have been open and transparent about their needed accommodations have found that their employers have willingly provided necessary adjustments – gaining back that employee’s long-term commitment and loyalty.

What kinds of accommodations are required by law?

Legislation and the Ontario Human Rights Commission have long expected employers to accommodate persons with disabilities in the workplace; but the fact that employers are less familiar with invisible disabilities sometimes means they are reluctant to employ persons with such disabilities.

Employers can successfully engage employees with specific needs by implementing some basic strategies:

- First, it is imperative that the employer know the individual, their needs and what, if applicable, triggers reactions or discomfort. For example, if sound causes overstimulation for them, the employee may simply need to wear headphones when working around others or in areas with disturbing noises, or have a soundproofing divider installed.

- Flickering monitors are another trigger for people with vision problems or who suffer from migraines, so adjusting lighting or screen brightness can help that person stay productive.

- Another strategy is to consider flexible working hours and locations; employees who may be experiencing pain from something like Lyme disease can adjust their work hours or even work from home where they may have devices or access to equipment throughout the day.

What is most critical, however, is that employers take the time to get to know their employees and be willing to meet them where they are, working together with their employees to develop accommodations that will work best for them. This practice engages the employee, giving them a voice in their working conditions that also demonstrates that their employer cares.

Changing internal processes

Perhaps the biggest adjustment for employers can be revisiting internal processes such as hiring practices, training and career development. As persons with invisible disabilities may be reluctant to disclose their disability, they may not even be able to get past a company’s interview screening. Expecting standardized practices to work for those who struggle in a standardized world, is simply not going to open the door to workers with needs that don’t fit the “cookie cutter.”

Once they have hired someone who needs accommodations, employers will also want to spend some time providing workplace education and training to help all employees understand various disabilities, so that relationships can flourish and resentment does not develop. Without understanding why a colleague wears headphones, arrives and works late, and has a private cubicle, or why they never make contact or require frequent breaks, other team members may develop jealousy or have less-trusting relationships with that colleague. Hence, having a plan to train all employees can go a long way in fostering a supportive work environment.

Another way to help employees with invisible disabilities integrate well is to discuss their future with the organization, to provide some reassurance that the employer has confidence in their ability and is willing to support their career development. Put in some time up-front to establish, monitor and revisit a growth and career plan to support these employees with future planning, skill development and goal-setting.

As most of us tend to believe what we see, invisible disabilities can be difficult for us to comprehend and accept. Yet, as employers are quickly discovering, within every disability, there often lies great ability. Hiring an employee with an invisible disability may not only result in good productivity and a loyal employee, it can also lead to a more tolerant and sensitive workplace for all, making minor accommodations seem trivial when compared with the greater overall benefits reaped.

References

Holland, J. (2017, June 6). The hidden challenges of invisible disabilities. Retrieved from www.bbc.com/capital/story/20170605-the-hidden-challenges-of-invisible-disabilities

Digital Management

Do You Own the Marketing Materials You Had Someone Create?

Last week, I received a call from a client. She had hired a company that specializes in website development to create and host a website for her small business. The website is now up and running and it looks great; but she received a letter demanding that she pay $8,000 as a licence fee for the use of one of the photos on it.

It turns out that her website developer had taken the photo from an online stock image company, and $8,000 is the licence fee payable by anyone who uses the photo, whether they knew about the licence fee or not. By having that photo on her website, my client was deemed to have agreed to pay the fee. Unfortunately, this type of demand letter is not at all unusual.

As we discussed the situation, I learned that my client had not signed a contract with the website developer; rather, she received a quote which merely told her what the cost would be and when the work would be finished. Essentially, unless the website developer does the honourable thing and pays the licence fee, she is on the hook for it.

Stock image companies

Stock image companies enter exclusive contracts with photographers and other artists to acquire and license images for commercial use. The photographers and artists are paid a royalty every time an image is used. Merely removing an image that was used without permission will not resolve the problem. The stock image company has a contractual obligation to its artist to obtain licence fees for the use of their images, whether the use was authorized or not.

The use of the image without a licence constitutes copyright infringement. The end user is liable for the infringement and must pay the retroactive licence fee. It is a strict liability offence – lack of knowledge doesn’t excuse or dismiss unauthorized use, nor does it affect your obligation to pay the licence fee.

“I found it on the internet”

Many people use images which they find on the internet. The fact that an image is found on the internet does not mean that it is in the public domain. Public domain is a very narrow exception to the Copyright Act and relates only to works in which the copyright has expired or in which the copyright owner has clearly declared that the work is not subject to copyright. As an aside, every time a client tells me that they are entitled to use something because it is in the public domain, I shudder. It almost always brings problems.

What is copyright?

Copyright is a bundle of rights which applies to certain types of work. That bundle includes the right to copy, reproduce and distribute the work. The scope of the works protected by copyright is very broad – the long list includes printed material such as books, manuals and instructions, artwork (including the logo you have created for your business and the paintings in your lobby), films, videos and software.

My client has a bigger problem – she doesn’t own her website

If you are having materials prepared, it’s important to be aware of certain provisions in Canada’s Copyright Act. The Copyright Act is a federal law, and it says that when work is created by an independent contractor (that is, by someone who is not your employee), the copyright in it belongs to the creator. This means that the creator controls what you can and cannot do with the work. For example, if you have a piece of software developed by someone who is not your employee, the copyright in that software will belong to the developer. You will merely have the right to use it, but you won’t be able to license it to others so that they can use it in connection with their businesses.

The only way of changing who owns the copyright is to have an agreement in writing, signed by the creator, assigning the copyright to you. Since my client didn’t get such an agreement, the website developer owns the copyright on her website. This could pose problems for her in the future.

What else should your contract deal with?

Copyright isn’t the only issue that your agreement should address:

- In addition to transferring the copyright to you, the agreement should also include an assurance from the creator that the work delivered to you will not infringe anyone else’s rights. In the case of a website, those rights include trademark, privacy, personality rights and, as my client learned, copyright.

- You should also consider whether you need an assurance of confidentiality (that the creator won’t reveal any information that you have provided about your business) and that the creator will not create something with a similar look and feel for anyone else, including one of your competitors.

- In addition, I recommend including a timeline for delivery, a process for changes and corrections, and a penalty for late delivery.

- Finally, every agreement should include some provision to deal with disputes. If you believe that the other side hasn’t met its obligations, are you entitled to cancel the agreement? Often, you will be entitled to give written notice of the default and if it isn’t remedied, you can cancel; but that right should be spelt out. Should you be required to go to court if there is a disagreement? Or can you go to arbitration? Again, this should be addressed in your agreement.

What if you receive a letter like my client received?

If you receive a letter saying that you have violated someone’s copyright, don’t ignore it! Unless you are certain that you have the right to use the image in question, speak with your lawyer. He or she will probably advise you to remove that image as soon as possible. If you are in the wrong, you may wish to consider negotiating with the holder of the rights. Sometimes it is possible to reach an agreement that will result in you paying less than the amount they demanded.

This article has been provided for general reference only. It is not intended to provide you with legal advice regarding a fact situation. For advice on an actual matter, you should consult a lawyer.

Technology

Antivirus Preparedness: What to Look for in an Antivirus Solution

Finding a good antivirus solution is kind of like searching for insurance coverage. We know we need it, but few of us really understand how it works. Here is a simple discussion outlining what antivirus software is, the threats out there and what to look for in selecting a security solution.

What is antivirus software exactly?

Antivirus software are programs that are specifically designed to deal with various forms of malicious software (often referred to as malware) that can infect your computer and cause data corruption, breach of privacy or many other forms of malintent. Typically, antivirus software is used to both prevent and remove the offending malware. Given that there are constantly new kinds of malware being released, a key aspect of antivirus software is the frequency and completeness with which it is updated.

The term antivirus has become synonymous with protection against a variety of threats, and not just viruses as the name suggests. It is worth understanding, at least at a high level, what the various forms of these threats are.

What threats should you be concerned about?

There are several different threats present in our modern environment. These are normally categorized by the method by which they are transmitted and/or by the malicious activity of the offending code and are collectively called “malware”. A few of the most prominent types of threats are listed below. This is by no means a complete list:

- Viruses – usually an executable file that has the capability of replicating itself, causing several different malicious intents. Executing the infected file activates or triggers the virus to act.

- Worms – similar to viruses in that they can replicate themselves, however they differ in that they do not require the execution of a file to trigger their activity and are transmitted by taking advantage of gaps in existing security protocols.

- Trojan horses – a type of malicious software or code that – as you can probably guess by the name – masquerades as legitimate software, and fools users into downloading it. Once downloaded and activated, a Trojan horse typically will open pathways for other malicious software to enter your PC.

- Spyware – malicious programs that, once they have found their way onto your computer, collect various pieces of data about you, your transactions and/or any data that resides on your PC. Once this personal data has been collected, the spyware will transmit it back somewhere to be collected by hackers, who could potentially steal your identity.

- Ransomware – probably the scariest of all the threats listed. In this case, the malicious software seeks out your important files – such as photos, documents, and videos – and encrypts them. Once these are all locked up, large sums of money are requested by the hackers to release your own files back to you.

Considerations when selecting antivirus software

Here are some important things to consider when evaluating an antivirus solution:

- Comprehensive coverage – With the many different threats that are out there, it is vital that you are looking for more than just antivirus coverage, but also for other forms of defence. Things like a firewall, internet browsing protection and even identity protection are key elements to have.

- Ease of use – No tool is worth anything if it won’t be used. Complicated pieces of software may provide a little better protection, but if it is not easy to understand, frustration will result. Look for easy-to-use screens, good documentation and options around how the product is configured.

- Performance impact – This is probably one of the biggest complaints about robust security solutions. They can use a fair amount of your PC’s resources to run the checks, scans and updates necessary to keep you protected. If you find that you see consistent slowness in your PC, regardless of the product used, it may be time to upgrade.

- Reliability – Reliable security software products have a few common elements. First, they are frequently updated, meaning that the provider is constantly adapting to new threats. Second, they have tools to automate the scanning process, and are highly configurable; so you can customize when they are run, and what files are investigated. They will also have a high malware-detection rate (look for a number higher than 95%). The high detection rate indicates that few viruses are missed, and conversely that most are caught. Lastly, they should guard against being unintentionally uninstalled, as some malware has been known to uninstall the antivirus software that is present. This is easily prevented by adding required confirmations to the uninstall process.

Free versus paid

This is a common debate. There are some good low- or no-cost antivirus products available, however most research does point to the paid product as having a better long-term rate of malware detection. The paid software is updated more frequently, is more robust in terms of functionality and comes with better support. Free solutions, while less feature-rich, may provide less interruption to your PC – however, remember that, at the end of the day, those interruptions are saving you from harm.

Disclaimer: BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.

Authors:

Why Should You Care About Your Health Care Spending Account? Adam McHenry, CFA

Workplace Accommodations: Choosing to See Ability in Disability Karlee Reece, CPA Canada

Do You Own the Marketing Materials You Had Someone Create? Christene H. Hirschfeld, Q.C., ICD.D

Antivirus Preparedness: What to Look for In an Antivirus Solution Cory Bayly, MBA